Funding growth in Australia through the R&D tax incentive

The Research and Development (R&D) tax incentive provides tax offsets designed to encourage companies to engage in R&D and innovation in Australia. Accessing the tax credit is an effective way to enhance business cashflow and provide funding to support product development and growth.

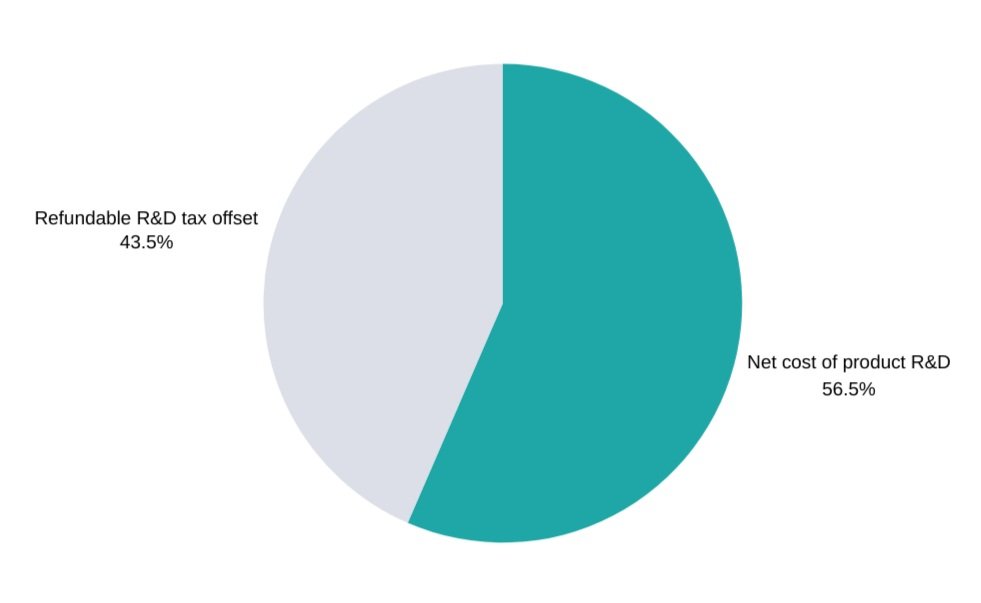

The incentive can potentially provide a 43.5% cash refund for eligible companies with a turnover of less than $20 million per year. Non-refundable tax offsets can be available for larger companies and can generally be carried forward.

Table A: Total refundable R&D tax offsets claimed for years up to 2022. Source: ATO company tax data published at data.gov.au

Total refundable R&D tax offsets claimed

The refundable R&D offset has grown substantially over the last few years, with the latest release of company tax data by the ATO showing ~$3.5 billion in refundable offsets claimed in the 2022 financial year.

Industry use of the R&D tax incentive

The R&D tax incentive is available to all Australian companies, provided the eligibility requirements are met. Table B below shows the top 10 industries with the largest R&D refundable offsets claimed in the 2022 financial year based on available ATO data. As would be expected, the largest claims are made in research and computer software related industries, but many industries are capturing the benefits of the claim.

Eligibility requirements

Generally, qualifying businesses need to meet the following threshold requirements to access the R&D incentive:

Your business has conducted eligible R&D activities (and receives the major benefit from those registered activities). Eligible R&D activities are generally described as ‘core’ and ‘supporting’ activities;

You have registered your activities with AusIndustry by the required date; and

You have incurred total R&D expenses (’notional R&D deductions’) for the financial year of at least $20,000.

The R&D concession is jointly administered by the Department of Industry, Science and Resources (AusIndustry) and the ATO. The ATO is responsible for administering compliance with the R&D program and making payment of the R&D offset through your company tax return.

What expenses can be claimed in calculating the R&D offset?

An eligible business is generally entitled to claim the following amounts in calculating the R&D credit:

expenditure on R&D activities during the financial year (including staff costs)

depreciation for assets used for R&D activities during the financial year.

Expenditure must be incurred for tax purposes (i.e. not merely accrued or provided for accounting purposes) before it may be claimed as a notional R&D deduction.

Taxpayers are required to keep sufficient records in relation to their R&D claim each financial year:

to support their self-assessment of R&D eligibility

to meet compliance obligations

to minimise costs if the ATO conduct a review of your application or registration; and

to verify the amount of expenditure incurred on R&D activities.

Table B: Top 10 industries claiming the R&D refundable offsets for the 2022 financial year. Source: ATO company tax data published at data.gov.au

Accessing the refundable R&D offset for eligible expenses can significantly reduce the net cost of product development.

How much is the R&D refundable offset?

The amount of the R&D offset is calculated by multiplying your total eligible expenses by the amount of the offset rate and claiming this in your company tax return. For small business taxpayers, the offset rate is 43.5% of the eligible expenses (including tax depreciation on assets used for R&D).

Assuming your business is in a tax loss position (as is often the case in the early stages of growth), the refundable tax credit provides for a direct cash refund of 43.5% of the total eligible R&D expenses. This can significantly reduce the cost of your product development.

How is the R&D offset paid to you?

The ATO processes the payment of the R&D refundable offsets through your company tax return. Once the tax return is lodged, the ATO will first apply the R&D refund to reduce your current year income tax payable in that return. Any surplus offset is refunded in cash. Where the company is in a tax loss position, the full 43.5% R&D refund should be refunded in cash to your business as noted above.

It’s important to remember that the ATO will apply any R&D refund owed to you first against outstanding tax liabilities, including amounts owed under ATO payment plans.

Financing solutions are available in the Australian market with specialist non-bank lenders to bring forward the benefit of the expected R&D refund to further assist with cashflow for your business.

Publication of R&D data by the ATO

The ATO is now required to publish the names of all companies that claimed the R&D concession in their tax returns through the annual R&D transparency report, which is expected to be published this month. The R&D data will be published 2 years after the relevant financial year end (i.e. the 30 June 2022 tax year information will be first disclosed this month in September 2024).

What information will be published?

The data the ATO will publish in the transparency report is specific and limited to the:

name of the R&D entity claiming the R&D

the entity's Australian business number (ABN) or Australian company number (ACN)

the 'total R&D expenditure' – total notional deductions claimed (label Z in Part A of the R&D TI schedule in the tax return) less any feedstock adjustments (label B in Part B of the R&D TI schedule).

Notes

[1] The incentive has 2 core components. For income years starting on or after 1 July 2021, entities engaged in R&D may be entitled to:

(a) refundable tax offset equal to the entity’s company tax rate plus an 18.5% premium for eligible entities with an aggregated turnover of less than $20 million per annum, provided they are not controlled by income tax-exempt entities

(b) non-refundable tax offset for all other eligible entities equal to the entity’s company tax rate plus a two-tiered premium determined on the notional R&D expenditure as a proportion of total expenditure for the income year. The new rates will be the company tax rate plus

8.5% for R&D expenditure up to 2% of total expenditure

16.5% for R&D expenditure above 2% of total expenditure.

Non-refundable R&D tax offsets can be utilised to reduce your tax payable to nil but can’t be refunded. Unused non-refundable tax offsets can be carried forward for use in future years.

[2] Each year the ATO publishes data extracted from tax returns for all Australian taxpayers, with the latest data set released in July 2024 capturing the 2022 financial year (as published at data.gov.au). The chart data included in this article is sourced from this published data.

[3] Expenses and tax depreciation claimed through the R&D concession are generally non-deductible for income tax purposes. Therefore, where the business is taxable, then the benefit of the R&D offset provides an incremental 18.5% cash refund benefit above the 25% small business company tax rate. Where the company is in a tax loss position, the full 43.5% R&D refund should be refunded in cash.

More information

Please reach out to us if you would like more information in relation to the R&D tax concession and to discuss your specific circumstances in more detail.